The AUD has been gaining ground against the GBP due to the uncertainty of it remaining in the European Union, making GBP denominated bonds more attractive. This note compares the relative value of five GBP bonds including a new bond just added to the DirectBond list

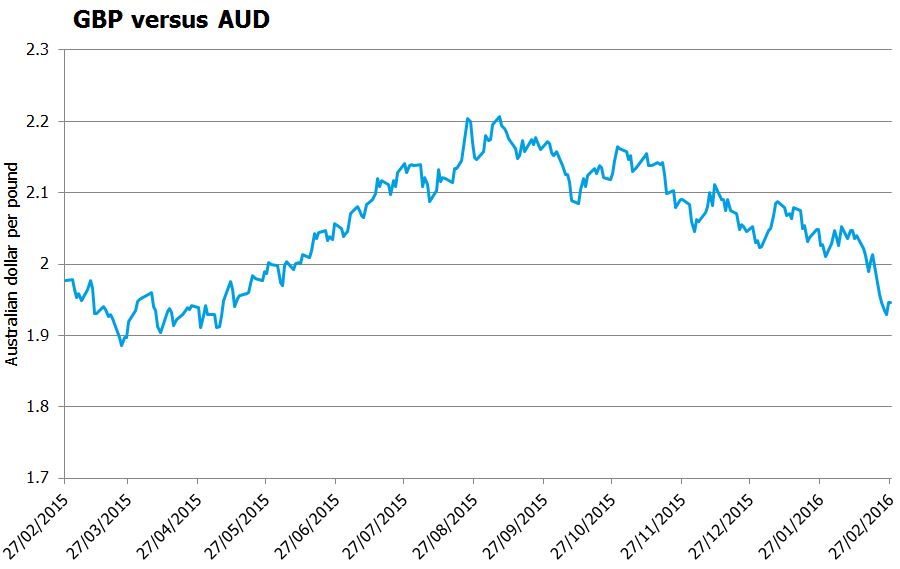

The cost to buy GBP has fallen relative to the AUD as shown in the graph below. However, the fundamentals of the UK economy remain relatively strong. A domestic market interest rate cut or confirmation that the UK remains in the EU could see the AUD fall relative to the GBP. We consider recent currency moves to be an opportunity to add GBP bonds to your portfolio.

Source: FIIG Securities, Bloomberg

We compare five fixed rate GBP bonds in the relative value chart below. For a pure currency hedge, investors should opt for short dated, low risk bonds. In that way, investors protect against:

- Price movements due to changes in perceived credit risk of the bond

- Possible increases in interest rates, which could also impact the price of the bond

In that case, the old style Swiss Re hybrid would be the preferred security.

For those concerned that interest rates may decline further, locking in a fixed rate for longer would be a priority and the BHP Billiton bond is a stand out.

Old Mutual has an impressive yield to call but is considerably higher risk. This bond is complex with much of the earnings derived from significant exposure to the South African rand. We no longer provide credit research on the company but do have a factsheet - see the link below.

Yesterday, the Glencore GBP fixed rated bond maturing in February 2019 was added to the DirectBond list. With only three years until maturity and an attractive yield to maturity of 6.50%, we like the risk and return proposition.

Source: FIIG Securities, Bloomberg Wholesale only fixed rate GBP portfolio

| Company name | Rating | Maturity/call date | Capital structure | Yield to maturity/call | Income (running yield) | Minimum face value parcel |

| BHP Billiton Finance USD Ltd | BBB+ | 22 October 2022 | Lower Tier 2 | 6.63% | 6.55% | GBP100,000 |

| Glencore Finance (Europe) S.A. | BBB- | 27 February 2019 | Senior debt | 6.50% | 6.50% | GBP50,000 |

| Old Mutual Plc | Ba2* | 24 March 2020 | Hybrid | 9.16% | 7.01% | GBP10,000 |

| Rabobank Capital Funding Trust IV | BBB- | 31 December 2019 | Tier 1 hybrid | 4.25% | 5.32% | GBP100,000 |

| Elm Bv (Swiss Rein Co) | A | 25 May 2019 | Tier 1 hybrid | 5.03% | 6.07% | GBP50,000 |

Source: FIIG Securities

Note: the above rates are indicative only accurate as at 29 February and are subject to change.

Bond are available to wholesale investors only.

*Not rated by S&P, Moody's rating included

For greater detail of the companies and bonds, please see links to research or factsheets below or contact your FIIG representative.

Note: A USD denominated Glencore bond maturing on 15 November 2021 has also been added to the DirectBond list. The minimum parcel is USD10,000. Current yield to maturity is 8.37% per annum.

Yields quoted are accurate as at 29 February 2016 but subject to change.